By Paxton DeVault OMAHA, Neb. – College students across the country are facing growing financial pressure from rising tuition to the increasing cost of rent, groceries and daily essentials. But at the University of Nebraska at Omaha, students are finding creative ways to make it work and learning lessons that go far beyond the classroom.

Rising tuition, rent and everyday expenses are putting pressure on college students nationwide, and right here in Omaha. For many, the biggest challenge isn’t just making it to class — it’s making ends meet.

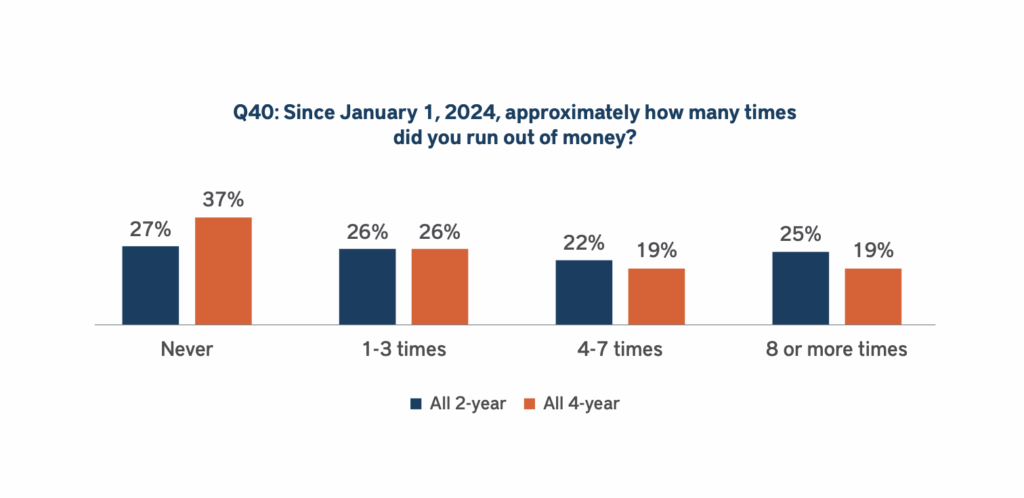

According to a recent national survey from the National College Attainment Network, more than two-thirds of college students reported running out of money at least once in 2024. Many said financial strain interfered with their ability to focus on schoolwork.

At UNO, junior psychology major Megan Addison said she’s felt that pressure firsthand.

“Last semester I had to take out one [loan] under my name,” Addison said. “I know eventually I’ll pay it off in the future once I do get that degree.”

Addison said she’s learning to build better financial habits, a skill she admits has taken time to develop.

“Moving forward, I’m probably gonna keep bigger savings and try to add onto it,” she said.

While many students continue to feel the financial strain of college, some UNO graduates say those struggles are part of what makes the experience worthwhile.

UNO alum Megan Reider, now a radio host and program director for Sweet 98.5, said her time in college was far from easy, but the payoff was worth it.

“Just like a lot of people, I took out student loans and tried to save up my tips and things from serving so I could rent books and save some money that way,” Reider said.

Reider graduated from UNO in 2013 with a bachelor’s degree in communications. She said that even though she worked full time and lived with her parents to cut costs, the connections she made at UNO helped launch her career.

“Had I not gone to UNO, I wouldn’t have networked and gotten to where I am,” Reider said. “College is worth it because you have to figure out what you want to do for the rest of your life, and the biggest thing I tell anyone in college is to save your money.”

For students still working to balance budgets and build savings, UNO offers several on-campus resources to help. Programs such as the Maverick Food Pantry, textbook rental services and emergency grants are available to help alleviate financial stress.

The UNO Financial Aid Office also encourages students to reach out early for guidance on managing expenses, applying for scholarships and using campus resources that can make college more affordable and less stressful.

For students like Addison, the cost of college can feel overwhelming, but both she and Reider agree that the investment pays off over time.

With careful planning, persistence and support from the university, students are proving that while higher education may come with financial challenges, the long-term rewards — both personal and professional — are worth every penny.

Leave feedback about this