by Paul Hammel, Nebraska Examiner

March 8, 2023

LINCOLN — Developers joined a state senator on Wednesday in seeking state help to create a “destination” retail-sports-entertainment complex that would rival “The Legends” area in Kansas City, which draws 15 million visitors a year.

Such a development — a proposed 1,000-acre expansion of the existing Nebraska Crossings outlet mall in Gretna — could include new-to-Nebraska retailers such as Ikea and Nordstrom’s, hotels and waterparks, as well as fields to host regional soccer and baseball tournaments.

“This could change Nebraska’s image as a fly-over state,” Gretna Mayor Mike Evans told the Legislature’s Revenue Committee.

Could be a ‘game changer’

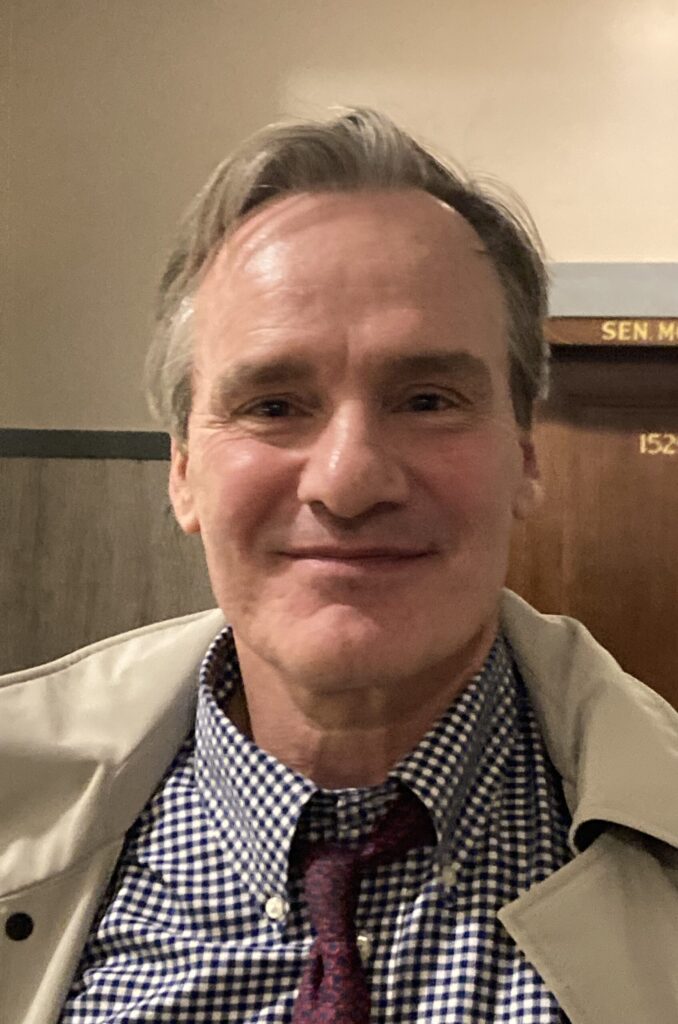

“This legitimately could be a game changer,” said State Sen. Lou Ann Linehan of Elkhorn.

Her Legislative Bill 692, the “Good Life Transformational Projects Act,” would help finance such huge developments by devoting up to half of the state’s 5.5-cent sales tax revenue in the district for development expenses. Various areas of the state could qualify, but testifiers for the bill Wednesday focused on the area of the Interstate 80 interchange with Nebraska Highway 31 at Gretna.

Rod Yates, the owner and developer of Nebraska Crossing, said that LB 692 is somewhat similar to “STAR bonds” — sales tax anticipation revenue bonds. Such state-backed bonds, financed by sales tax revenue, provided $450 million toward the development of the Legends area in Kansas City, Kansas.

Besides more than 75 outlet stores, the Legends area is surrounded by several other attractions, including stadiums for professional soccer and minor league baseball teams, a waterpark, the Kansas Speedway and a Nebraska Furniture Mart store.

Yates at one time was involved in the multimillion-dollar transformation vision for Omaha’s Crossroads mall, but his business partner ended up joining forces with a different developer.

‘Retail leakage’ to other states

Promoters said that Nebraska loses an estimated $1.6 billion a year in “retail leakage” to other states and that a proposed 1,000-acre expansion of Nebraska Crossing would keep shoppers in the state and lure youth sports tournaments now held in other states.

“Youth sports is a $25 billion a year industry, and Nebraska right now gets zero,” Yates said.

Robb Heineman, a sports developer and part-owner of the Sporting Kansas City professional soccer team, said Nebraska is “totally underserved” in terms of soccer complexes.

He said the Legends area has eight baseball fields and 10 soccer fields and is adding a 200,000-square-foot building for athletic training and volleyball. Similar facilities would be envisioned at Nebraska Crossing, Heineman said.

In recent years, state lawmakers have provided incentives for construction of several youth sports complexes, from LaVista to Valley and Lincoln, spawning an “arms race” of sorts for “sports tourism” spending by families. But Yates said there’s still room for more.

Untapped potential

He said that Nebraska Crossing also has untapped potential for retail growth and that stores that might not consider locating in Nebraska would be drawn to a new development because it would serve both the Omaha and Lincoln areas.

“I believe we’re still in the third inning in terms of potential,” he said.

Under the bill, the state would devote up to half of the state sales taxes generated by Nebraska Crossing and the new “Good Life” district toward the costs of the expansion. The state benefits would extend for 25 years.

Projections handed out by promoters of the project estimated that an additional $20 million in sales tax revenue would be generated per year within five years, growing to nearly $40 million after 25 years.

Promoters said the state’s foregone sales tax revenue would be repaid after four years via increased sales.

Minimum $500 million investment

Under LB 692, a minimum investment of $500 million would be required in a county the size of Sarpy County to qualify for Good Life benefits. At least 20% of the sales generated would have to come from out-of-state shoppers, but Yates said 30% of Nebraska Crossing’s customers are already non-Nebraskans.

STAR bonds have generated controversy in Kansas, where critics have questioned whether they realized the ambitious tourism goals that were targeted.

Linehan, who chairs the Legislature’s Revenue Committee, said the best kind of tax is one paid by out-of-staters and said such revenue could help address the state’s over-reliance on property taxes.

She added such a development would help tie in with other tourist attractions in the area, mentioning Schramm and Mahoney State Parks, the Cloisters on the Platte retreat center and a proposed huge sandpit lake near Linoma Beach.

The fiscal note prepared by the Legislature’s Fiscal Office stated that the bill might violate a requirement that the state have only one sales tax rate. But Linehan said that she would work out that problem.

Yates said that unless the state helps to finance the proposed development, it won’t happen, and the area would be destined for construction of new truck stops or industrial buildings.

“Or we could have a beautiful new destination,” he said. “It could be the front door to Nebraska if it’s done right.”

The Revenue Committee took no action on LB 692 after its public hearing Wednesday. But Linehan said passage of the bill would be a priority of hers this year.

Nebraska Examiner is part of States Newsroom, a network of news bureaus supported by grants and a coalition of donors as a 501c(3) public charity. Nebraska Examiner maintains editorial independence. Contact Editor Cate Folsom for questions: info@nebraskaexaminer.com. Follow Nebraska Examiner on Facebook and Twitter.

Leave feedback about this